Corporate Profile

| << Back |

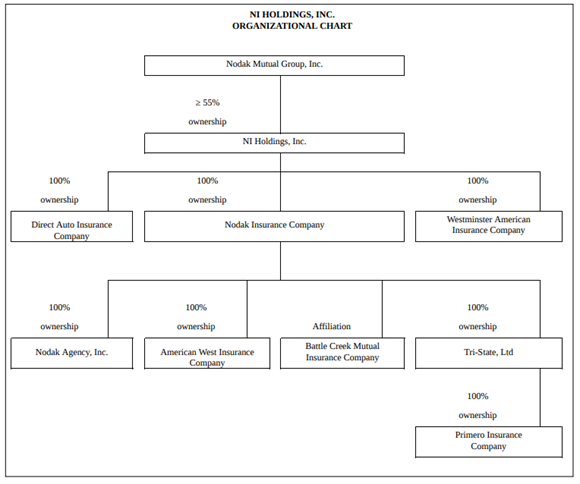

NI Holdings, Inc.is a publicly held holding company that generates results from property and casualty insurance company operations. Specifically, results are generated through the operations of Nodak Insurance Company and its affiliates. Nodak Insurance markets and distributes its policies through its captive agents, while all other companies utilize the independent agent distribution.

NI Holdings common stock trades on NASDAQ under ticker NODK. The majority of NI Holdings stock is held by Nodak Mutual Group, Inc., which operates as a mutual holding company.

Corporate Structure

NI Holdings, Inc. is a North Dakota business corporation that is the stock holding company of Nodak Insurance Company and became such in connection with the conversion of Nodak Mutual Insurance Company from a mutual to stock form of organization and the creation of a mutual holding company. The conversion was completed on March 13, 2017. Immediately following the conversion, all of the outstanding shares of common stock of Nodak Insurance Company were issued to Nodak Mutual Group, which then contributed the shares to NI Holdings in exchange for 55% of the outstanding shares of common stock of NI Holdings. Nodak insurance then became a wholly-owned stock subsidiary of NI Holdings.

- Nodak Insurance Company

- Nodak Insurance is the largest domestic property and casualty insurance company in North Dakota, offering private passenger auto, homeowners, farmowners, commercial multi-peril, crop hail, and Federal multi-peril crop insurance coverages through its captive agents in the state.

- American West Insurance Company

- American West is a property and casualty insurance company licensed in eight states in the Midwest and Western regions of the United States.American West began writing policies in 2002 and primarily writes personal auto, homeowners, and farm coverages in South Dakota. American West also writes personal auto coverage in North Dakota, as well as crop hail and Federal multi-peril crop insurance coverages in Minnesota and South Dakota.

- Primero Insurance Company

- Primero is a wholly-owned subsidiary of Tri-State, Ltd. Tri-State, Ltd. is an inactive shell corporation 100% owned by Nodak Insurance. Primero is a property and casualty insurance company writing non-standard automobile coverage in the states of Nevada, Arizona, North Dakota, and South Dakota. Primero was acquired by Nodak Insurance in 2014.

- Battle Creek Mutual Insurance Company

- Battle Creek is a property and casualty insurance company writing personal auto, homeowners, and farm coverages solely in the state of Nebraska.

- Battle Creek became affiliated with Nodak Insurance in 2011, and Nodak Insurance provides underwriting, claims management, policy administration, and other administrative services to Battle Creek.

- Direct Auto Insurance Company

- Direct Auto is a property and casualty insurance company licensed in Illinois. Direct Auto began writing non-standard automobile coverage in 2007, and was acquired by NI Holdings on August 31, 2018 via a stock purchase agreement.

- Westminster American Insurance Company

- Westminster is a property and casualty insurance company licensed in seventeen states and the District of Columbia. Westminster is headquartered in Owings Mills, Maryland and underwrites commercial multi-peril insurance in the states of Delaware, Georgia, Maryland, New Jersey, North Carolina, Pennsylvania, South Carolina, Virginia, West Virginia, and the District of Columbia. Westminster was acquired by NI Holdings on January 1, 2020 via a stock purchase agreement.

Financial Strength Rating

All of the Company’s insurance subsidiary and affiliate companies are rated “A” Excellent by AM Best, which is the third highest out of 15 possible ratings, under a group rating due to the intercompany pooling reinsurance agreement. AM Best has affirmed a stable financial strength outlook to the group.